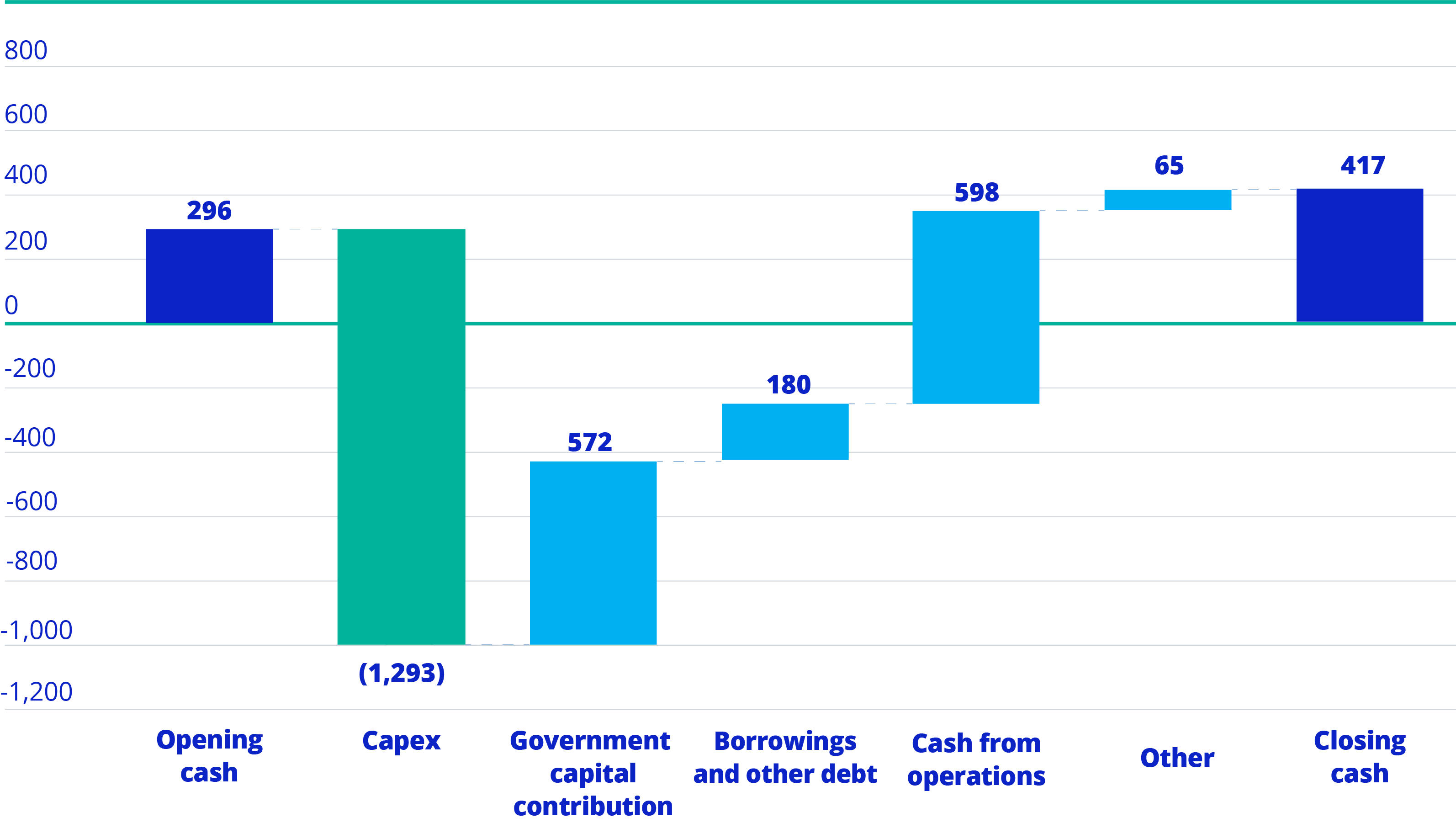

Net debt and cash flows

The net debt position at 31 December 2024 was €597m (total borrowings and other debt of €1,013m, less cash and cash equivalents of €417m), compared to €534m in the prior year.

In 2024, capital investment funding requirements (€1,293m in cash outlay terms) were partially met by the capital contribution funding received from Government of €572m, resulting in a residual capital investment funding requirement of €721m. The net cash increase from borrowings and other debt of €180m, along with positive operating cash flows of €598m, were utilised to meet this residual capital funding requirement.

Other net cash inflows of €65m primarily relate to a €63m net cash movement in respect of third party collateral. Further to an IFRS agenda decision, which Uisce Éireann adopted in 2022, third party collateral is presented as cash unless it is held on deposit terms of greater than 3 months, in which case it is presented as a financial asset (see note 1 of the Financial Statements). This €63m net cash movement can be analysed as €31m cash inflow due to increased collateral held at year end along with €32m being placed on deposit terms of less than 3 months, and so is presented as cash and cash equivalents rather than as a financial asset.

This resulted in closing cash and cash equivalents at year end of €417m.

Capital resources

As at 31 December 2024, Uisce Éireann held;

- total drawn borrowings of €999m (excludes lease liabilities of €15m),

- undrawn National Treasury Management Agency (NTMA) working capital facility of €350m, and

- €417m of cash and cash equivalents.

As at 31 December 2024, €999m of State loan facilities have been provided by the Minister for Finance for capital expenditure attributed to the non-domestic sector, €184m of which was drawn down in 2024 and reflects the final facility available under the facilities agreement.

Uisce Éireann has committed to ensuring that the NTMA working capital facility remains undrawn on 31 December each calendar year, unless Uisce Éireann has obtained prior Ministerial agreement to utilise the facility. Uisce Éireann also has a €10m uncommitted overdraft facility to help manage its daily banking requirements.

In the Government’s 2025 Budget, it was announced that €1bn of funding would be provided by the Minister for Finance to support the capital investment included in the approved Strategic Funding Plan 2025-2029. €300m would be provided in 2025 to fund domestic capital investment, with €700m provided to fund non-domestic capital investment over the period 2025-2027, €214m of which will be provided in 2025.

At 31 December 2024, the weighted average interest rate on the Company’s portfolio of outstanding borrowings was 1.83% (2023: 1.53%) and the average maturity of its debt was 7.61 years (2023: 8.09 years).

Treasury governance

The responsibility for treasury activity and its performance rests with the Board, which exercises its responsibility through regular review. The Audit and Risk Committee provides oversight of the risk and control environment on behalf of the Board. Uisce Éireann has complied with the requirements and conditions of the Minister for Finance under the Financial Transactions of Certain Companies and Other Bodies Act, 1992. The Uisce Éireann treasury function is not operated as a profit centre and treasury positions are managed in a risk averse manner. All treasury transactions have a valid underlying business reason and speculative positions are strictly prohibited. Further details of our treasury governance financial risk management policies are set out in the Financial Statements note 22.